Beaver County Property Tax Rate . Web the predetermined ratio in beaver county is 100%. Each july 1, the tax equalization division of the pennsylvania department. Web providing beaver county taxpayers avenues to search real estate assessment and delinquent tax records. Web use the beaver county property tax calculator to verify your tax bill or to estimate the annual real estate taxes with. Web the median property tax (also known as real estate tax) in beaver county is $1,909.00 per year, based on a median home value. The municipal mill rate, the education mill rate and the seniors mill. Your property tax is made up of three components; Web this page contains the property tax rates (millage) for borough, township and school districts in beaver county, pa. Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s.

from www.davidrumsey.com

Your property tax is made up of three components; Web the median property tax (also known as real estate tax) in beaver county is $1,909.00 per year, based on a median home value. Each july 1, the tax equalization division of the pennsylvania department. Web this page contains the property tax rates (millage) for borough, township and school districts in beaver county, pa. Web providing beaver county taxpayers avenues to search real estate assessment and delinquent tax records. Web the predetermined ratio in beaver county is 100%. Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. The municipal mill rate, the education mill rate and the seniors mill. Web use the beaver county property tax calculator to verify your tax bill or to estimate the annual real estate taxes with.

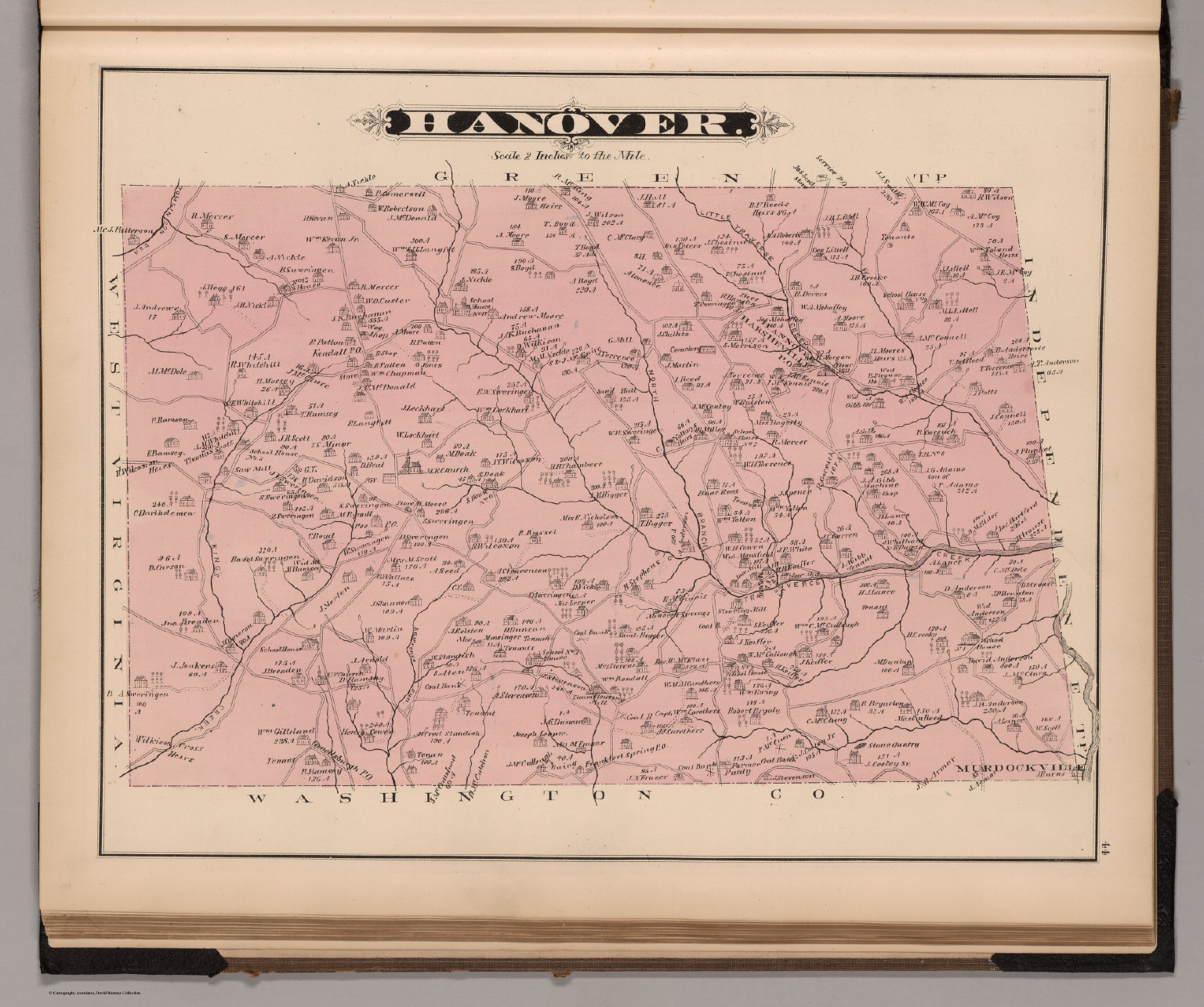

Hanover Township, Beaver County, PA. David Rumsey Historical Map

Beaver County Property Tax Rate Each july 1, the tax equalization division of the pennsylvania department. Web use the beaver county property tax calculator to verify your tax bill or to estimate the annual real estate taxes with. Web this page contains the property tax rates (millage) for borough, township and school districts in beaver county, pa. Web providing beaver county taxpayers avenues to search real estate assessment and delinquent tax records. Your property tax is made up of three components; Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. Web the predetermined ratio in beaver county is 100%. The municipal mill rate, the education mill rate and the seniors mill. Each july 1, the tax equalization division of the pennsylvania department. Web the median property tax (also known as real estate tax) in beaver county is $1,909.00 per year, based on a median home value.

From www.youtube.com

New Beaver County property tax assessments leave some residents with Beaver County Property Tax Rate Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. Web the median property tax (also known as real estate tax) in beaver county is $1,909.00 per year, based on a median home value. Your property tax is made up of three components; The municipal mill rate, the education mill rate and. Beaver County Property Tax Rate.

From www.signnow.com

Beaver County Homestead Exemption 20222024 Form Fill Out and Sign Beaver County Property Tax Rate Web this page contains the property tax rates (millage) for borough, township and school districts in beaver county, pa. Each july 1, the tax equalization division of the pennsylvania department. Your property tax is made up of three components; Web use the beaver county property tax calculator to verify your tax bill or to estimate the annual real estate taxes. Beaver County Property Tax Rate.

From www.landwatch.com

Beaver, Beaver County, OK Farms and Ranches for sale Property ID Beaver County Property Tax Rate Each july 1, the tax equalization division of the pennsylvania department. Web providing beaver county taxpayers avenues to search real estate assessment and delinquent tax records. Your property tax is made up of three components; Web use the beaver county property tax calculator to verify your tax bill or to estimate the annual real estate taxes with. Web the predetermined. Beaver County Property Tax Rate.

From carolaqlyndsay.pages.dev

California Property Tax Increase 2024 Sandy Cornelia Beaver County Property Tax Rate Web the predetermined ratio in beaver county is 100%. Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. Each july 1, the tax equalization division of the pennsylvania department. Web the median property tax (also known as real estate tax) in beaver county is $1,909.00 per year, based on a median. Beaver County Property Tax Rate.

From beavercountyradio.com

How Do You Figure Out Your New Taxes After The Beaver County Beaver County Property Tax Rate Web this page contains the property tax rates (millage) for borough, township and school districts in beaver county, pa. Web providing beaver county taxpayers avenues to search real estate assessment and delinquent tax records. Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. Web the predetermined ratio in beaver county is. Beaver County Property Tax Rate.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Beaver County Property Tax Rate Web the predetermined ratio in beaver county is 100%. Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. Your property tax is made up of three components; Web providing beaver county taxpayers avenues to search real estate assessment and delinquent tax records. Web the median property tax (also known as real. Beaver County Property Tax Rate.

From irmaqnonnah.pages.dev

Ca Property Tax Rate 2024 Chad Meghan Beaver County Property Tax Rate Your property tax is made up of three components; Web use the beaver county property tax calculator to verify your tax bill or to estimate the annual real estate taxes with. Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. Each july 1, the tax equalization division of the pennsylvania department.. Beaver County Property Tax Rate.

From learningdarkvonhack2n.z21.web.core.windows.net

Texas State And Local Sales Tax Rate 2023 Beaver County Property Tax Rate Web use the beaver county property tax calculator to verify your tax bill or to estimate the annual real estate taxes with. Web the median property tax (also known as real estate tax) in beaver county is $1,909.00 per year, based on a median home value. Web this page contains the property tax rates (millage) for borough, township and school. Beaver County Property Tax Rate.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Beaver County Property Tax Rate Web the median property tax (also known as real estate tax) in beaver county is $1,909.00 per year, based on a median home value. Web the predetermined ratio in beaver county is 100%. The municipal mill rate, the education mill rate and the seniors mill. Web this page contains the property tax rates (millage) for borough, township and school districts. Beaver County Property Tax Rate.

From exofiljzj.blob.core.windows.net

Montgomery County Ohio Property Tax Increase 2022 at Milagros Mattingly Beaver County Property Tax Rate Web the median property tax (also known as real estate tax) in beaver county is $1,909.00 per year, based on a median home value. Web this page contains the property tax rates (millage) for borough, township and school districts in beaver county, pa. Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and. Beaver County Property Tax Rate.

From beavercountyradio.com

County Gains7.2 Million From Property Tax Increase Beaver County Radio Beaver County Property Tax Rate Web this page contains the property tax rates (millage) for borough, township and school districts in beaver county, pa. Your property tax is made up of three components; Web the predetermined ratio in beaver county is 100%. Web use the beaver county property tax calculator to verify your tax bill or to estimate the annual real estate taxes with. Web. Beaver County Property Tax Rate.

From cenlzzgl.blob.core.windows.net

Maryland County Property Tax Rates 2020 at Randolph Sheaffer blog Beaver County Property Tax Rate Each july 1, the tax equalization division of the pennsylvania department. Web use the beaver county property tax calculator to verify your tax bill or to estimate the annual real estate taxes with. Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. Web the median property tax (also known as real. Beaver County Property Tax Rate.

From www.uslandgrid.com

Beaver County Tax Parcels / Ownership Beaver County Property Tax Rate Web the predetermined ratio in beaver county is 100%. Web this page contains the property tax rates (millage) for borough, township and school districts in beaver county, pa. Web providing beaver county taxpayers avenues to search real estate assessment and delinquent tax records. Each july 1, the tax equalization division of the pennsylvania department. Your property tax is made up. Beaver County Property Tax Rate.

From exonqcizn.blob.core.windows.net

Cumberland Maine Property Tax Rate at Cynthia Webster blog Beaver County Property Tax Rate Web the predetermined ratio in beaver county is 100%. Web providing beaver county taxpayers avenues to search real estate assessment and delinquent tax records. Each july 1, the tax equalization division of the pennsylvania department. The municipal mill rate, the education mill rate and the seniors mill. Web use the beaver county property tax calculator to verify your tax bill. Beaver County Property Tax Rate.

From cenlzzgl.blob.core.windows.net

Maryland County Property Tax Rates 2020 at Randolph Sheaffer blog Beaver County Property Tax Rate Each july 1, the tax equalization division of the pennsylvania department. Web use the beaver county property tax calculator to verify your tax bill or to estimate the annual real estate taxes with. Web the median property tax (also known as real estate tax) in beaver county is $1,909.00 per year, based on a median home value. Web providing beaver. Beaver County Property Tax Rate.

From www.facebook.com

9/17/24 Common Council meeting 9/17/24 Common Council meeting By Beaver County Property Tax Rate Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. Each july 1, the tax equalization division of the pennsylvania department. Web providing beaver county taxpayers avenues to search real estate assessment and delinquent tax records. Web the median property tax (also known as real estate tax) in beaver county is $1,909.00. Beaver County Property Tax Rate.

From exoqweyvc.blob.core.windows.net

Union County Property Tax Rate 2021 at Dexter Nesbitt blog Beaver County Property Tax Rate Web this page contains the property tax rates (millage) for borough, township and school districts in beaver county, pa. Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. The municipal mill rate, the education mill rate and the seniors mill. Web the median property tax (also known as real estate tax). Beaver County Property Tax Rate.

From www.davidrumsey.com

Hanover Township, Beaver County, PA. David Rumsey Historical Map Beaver County Property Tax Rate Web the predetermined ratio in beaver county is 100%. Web the treasurer’s office collects current year’s county property taxes and issues dog, hunting, fishing licenses and sportsmen’s. Web this page contains the property tax rates (millage) for borough, township and school districts in beaver county, pa. Web use the beaver county property tax calculator to verify your tax bill or. Beaver County Property Tax Rate.